Politics

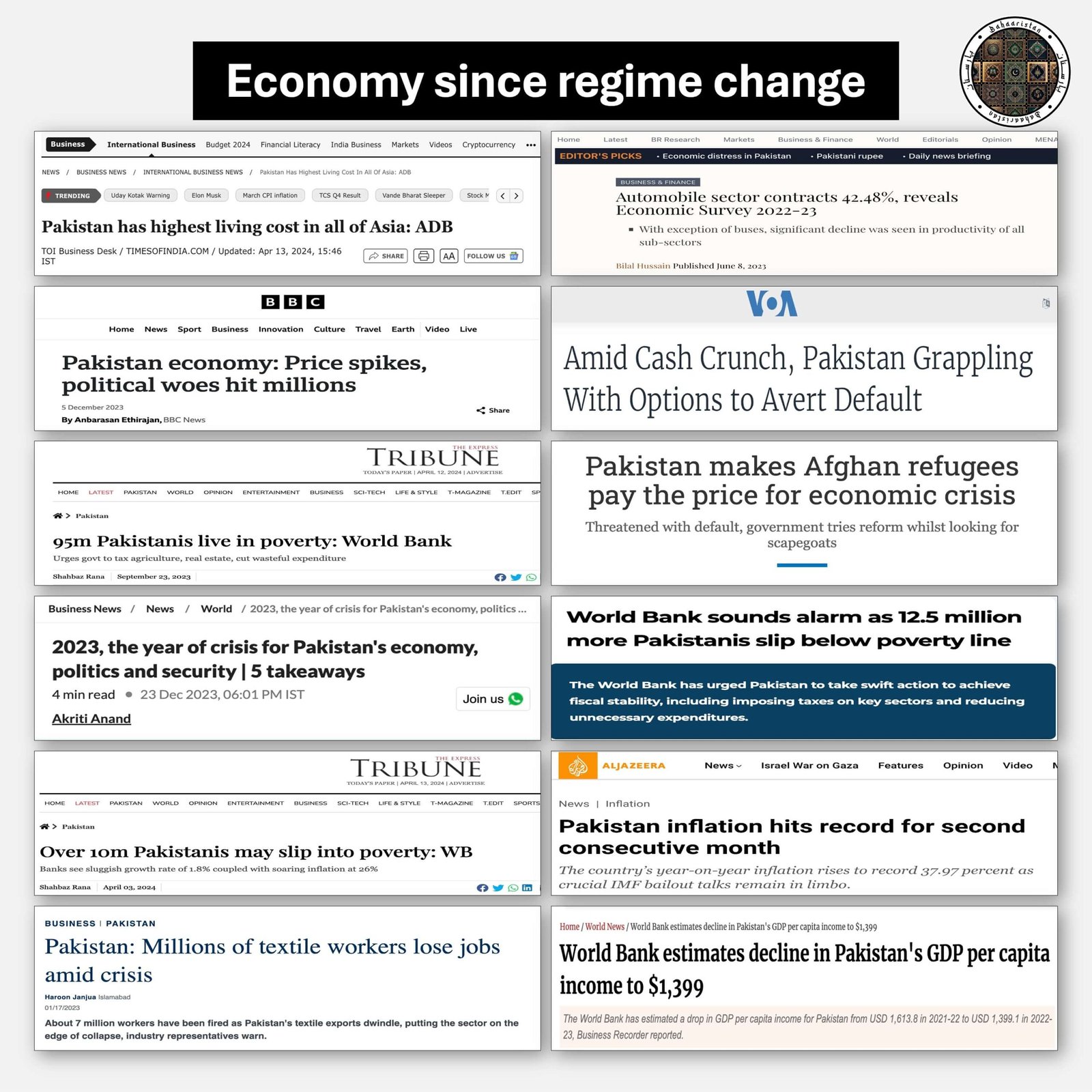

Pakistan’s economy since the Regime Change Operation

The regime change operation in Pakistan plunged the country into political turmoil, resulting in uncontrollable economic turbulence.

In March 2022, the Pakistan Democratic Movement (PDM) tabled a no-confidence motion against then-Prime Minister Imran Khan. Among the various reasons cited by the PDM for this move was the state of Pakistan’s economy under Imran Khan’s government. Specifically, the PDM and media highlighted high inflation during that period, which they claimed had severely impacted the Pakistani economy.

While Pakistan’s economy has faced challenges for decades, it is now widely acknowledged that the economy had stabilized under the PTI government and was on a path towards robust growth. However, the regime change operation, made possible by the PDM’s no-confidence motion against Imran Khan, plunged the country into political turmoil, resulting in uncontrollable economic turbulence.

History of Pakistan’s economy

Pakistan has grappled with economic mismanagement, imprudent policies, and misplaced priorities for years. This has resulted in substantial external debt, a severe balance of payment crisis, persistent fiscal deficits, weak exports, and low remittances. These challenges have persisted over successive governments, none of which have effectively addressed the underlying structural issues. Instead, short-term measures were taken primarily to gain votes during elections, exacerbating Pakistan’s economic crisis.

Between 2013 and 2018, PMLN’s flawed economic policies crippled Pakistan’s economic foundations. Ishaq Dar, then-finance minister, maintained an overvalued currency against the US dollar, causing irreparable damage to the economy:

- Increased imports due to the overvalued PKR, making foreign goods cheaper and transforming Pakistan into an import-based economy

- Decreased exports, resulting in a significant blow to the local industry, exacerbated by the record-high current account deficit and balance of payment crisis

- Depletion of crucial forex reserves due to the fixed exchange rate against the US dollar

Pakistan’s economy under the PTI government

When Imran Khan came into power in 2018, his government inherited a bankrupt economy and faced multiple challenges. Therefore, tough economic measures were implemented under Khan’s leadership to:

- prevent a default

- control the current account balance

- build foreign exchange reserves

- revive the local industry

- transition to a market-based exchange rate policy

These measures initially addressed immediate challenges. However, the onset of the Covid-19 pandemic brought significant additional hurdles. Nevertheless, Imran Khan’s exceptional decision-making throughout Covid helped Pakistan navigate the crisis relatively unscathed, and Pakistan’s Covid response was hailed globally for managing to save both lives and livelihoods effectively.

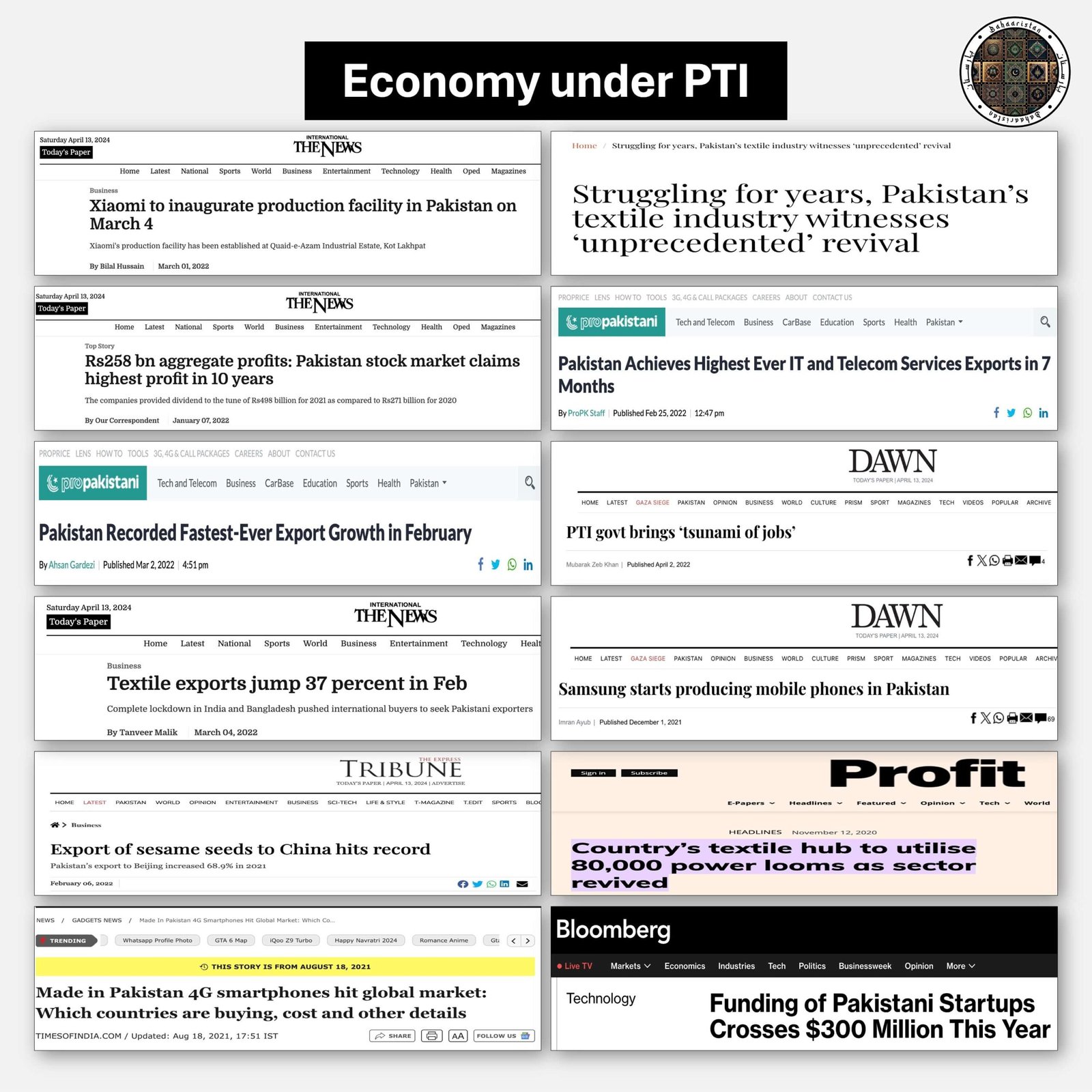

Key economic achievements and highlights from PTI’s government include:

- Best consecutive two years of GDP growth under a civilian government

- Highest-ever exports in Pakistan’s history

- Controlled current account balance

- Corporate profits reached a 10-year high

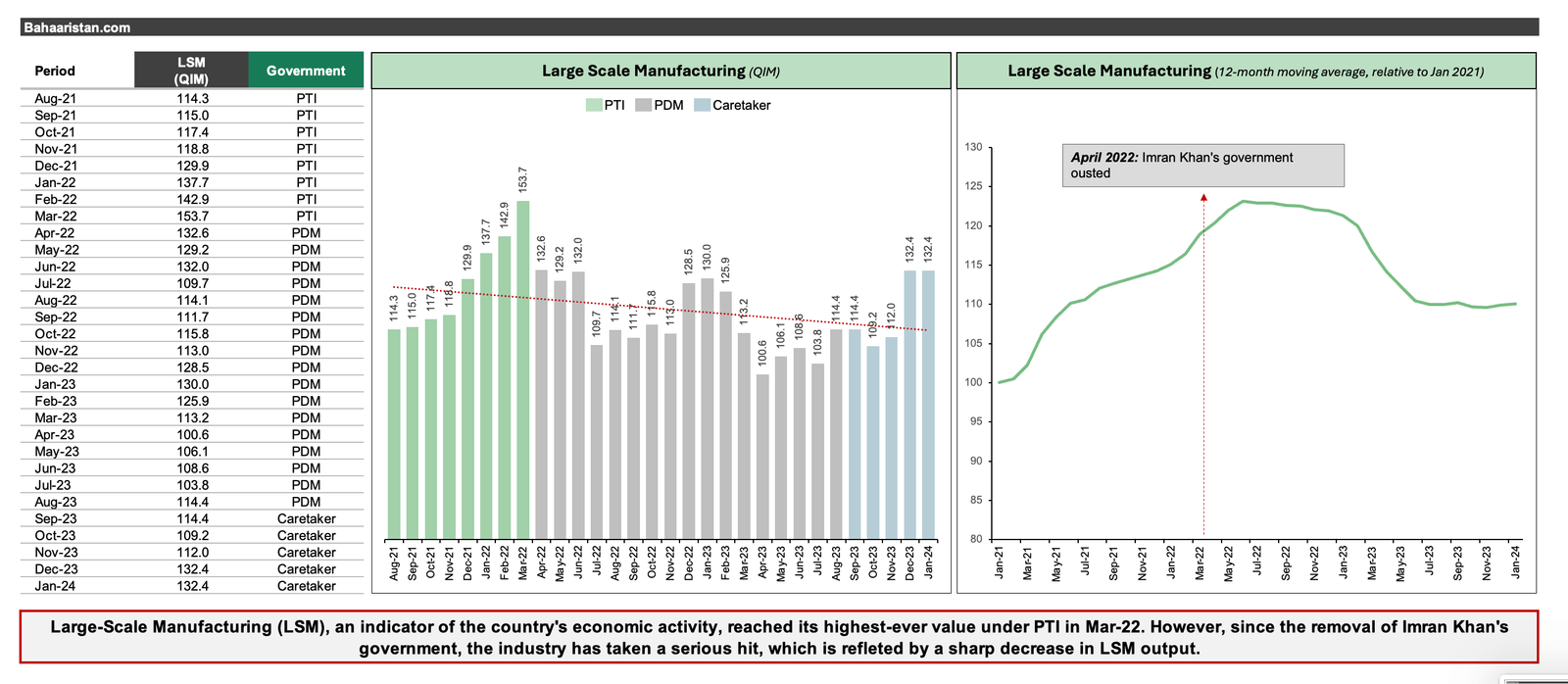

- Large-scale manufacturing at an all-time high

- Highest-ever technology exports

- Creation of 5.5 million jobs in three years, the best performance in 15 years

- All-time high remittances into Pakistan

- Record high investment in Pakistani startups

- ‘Unprecedented’ revival of textile industry

Here are some of the top economic headlines from Pakistan during Imran Khan’s government:

Pakistan’s economy since the regime change operation

The ouster of Imran Khan created political instability and sent Pakistan’s economy into a tailspin, from which it hasn’t recovered since. All key economic indicators have deteriorated, and with massive debt servicing requirements, the economy is on the verge of a catastrophic collapse.

Key economic indicators of Pakistan’s economy over the last two years reflect this situation appropriately:

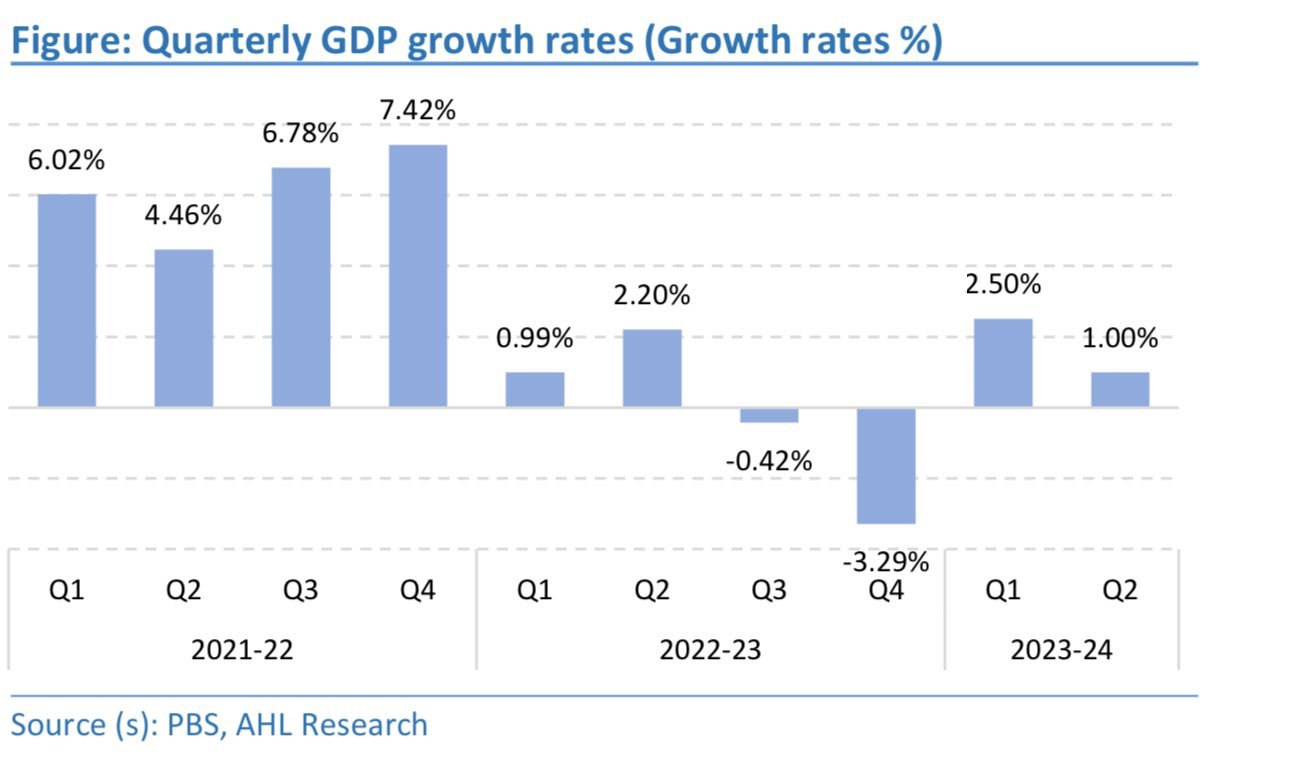

Pakistan’s GDP growth

The last two years of Imran Khan’s government, FY2021 & FY2022, witnessed robust economic growth (as acknowledged by the IMF) of 5.8% and 6.2%, respectively. However, Pakistan’s economy under PDM suffered severe setbacks, with GDP contracting to 0.3% in FY2023.

Analyzing quarterly data, GDP showed remarkable growth in the third and fourth quarters of FY22 but experienced a significant decline in FY2023.

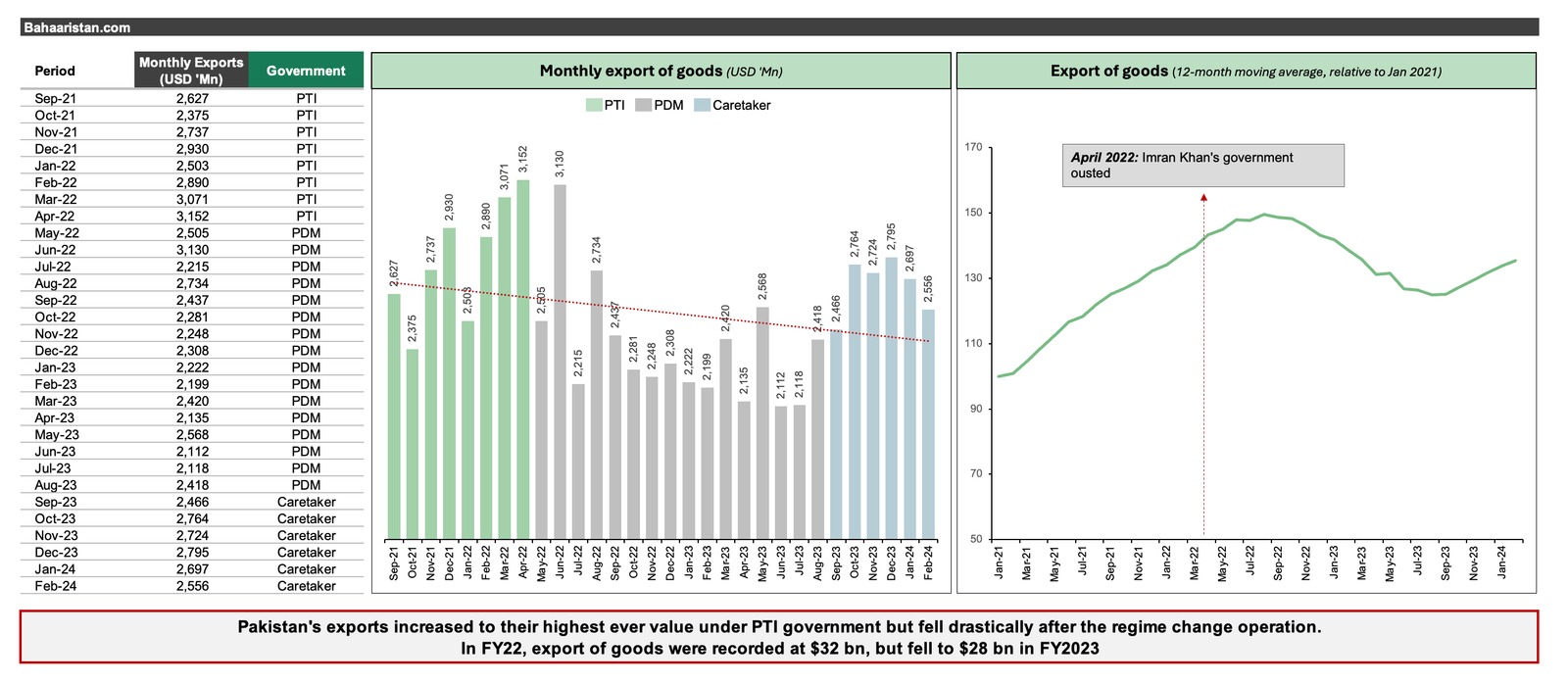

Pakistan’s Exports

In March 2022, the final month of Imran Khan’s government, monthly exports surpassed US$ 3 billion for the first time in Pakistan’s history. This momentum continued until June 2022, after which exports tumbled. In FY22, exports hit their highest-ever value, $32 billion, but fell to $28 billion in FY23.

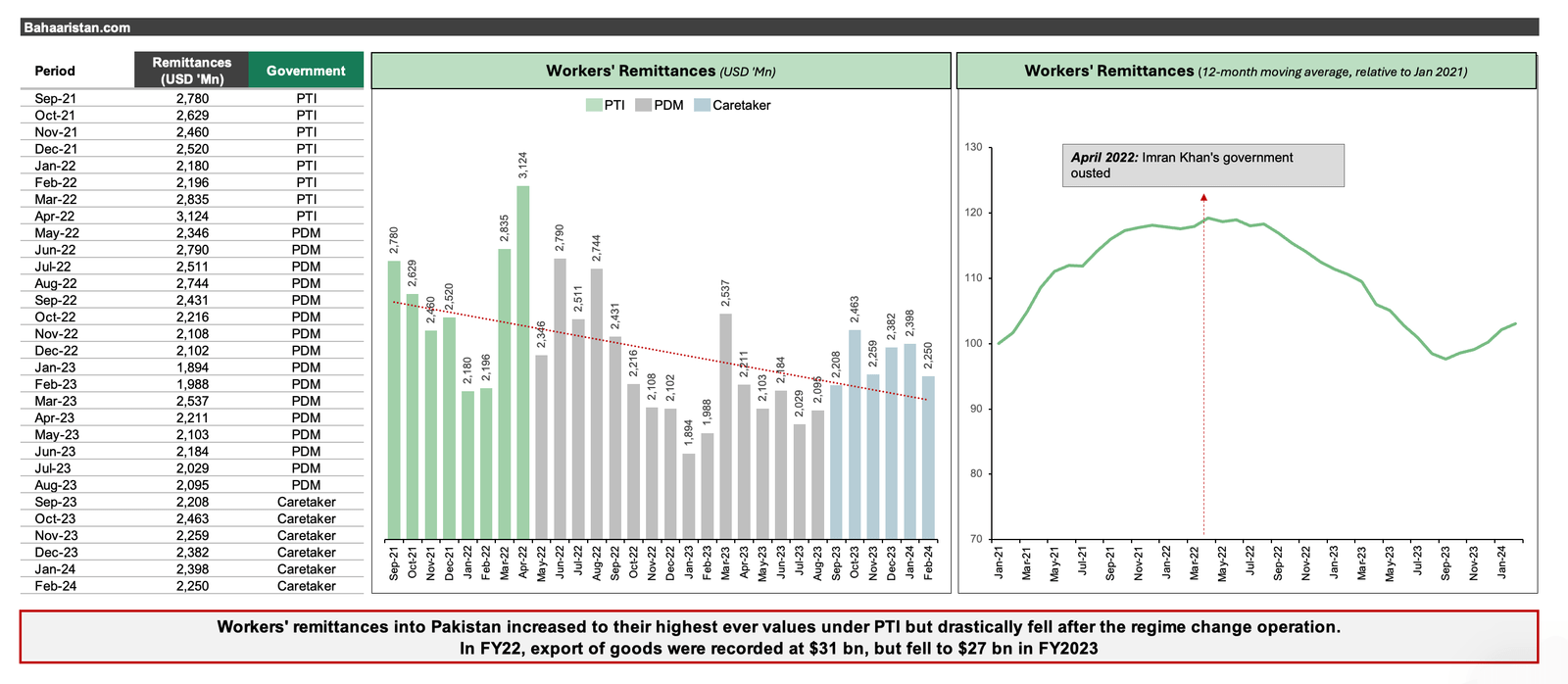

Pakistan’s Remittances

Simultaneously, overseas Pakistanis, likely in protest against repressive tactics and influenced by flawed macroeconomic policy decisions, diverted their remittances through unofficial channels. In FY22, remittances recorded their highest-ever value, $31 billion, but fell to $27 billion in FY23.

For context, after taking over the government, the PDM revoked overseas voting rights in an attempt to sway electoral outcomes in their favour. Additionally, Ishaq Dar (the finance minister) once again pursued the policy of pegging the rupee against the US dollar, leading to an overvalued rupee and creating black markets with inflated dollar values. Consequently, people preferred unofficial means to send remittances to Pakistan, resulting in a sharp decline in documented remittances.

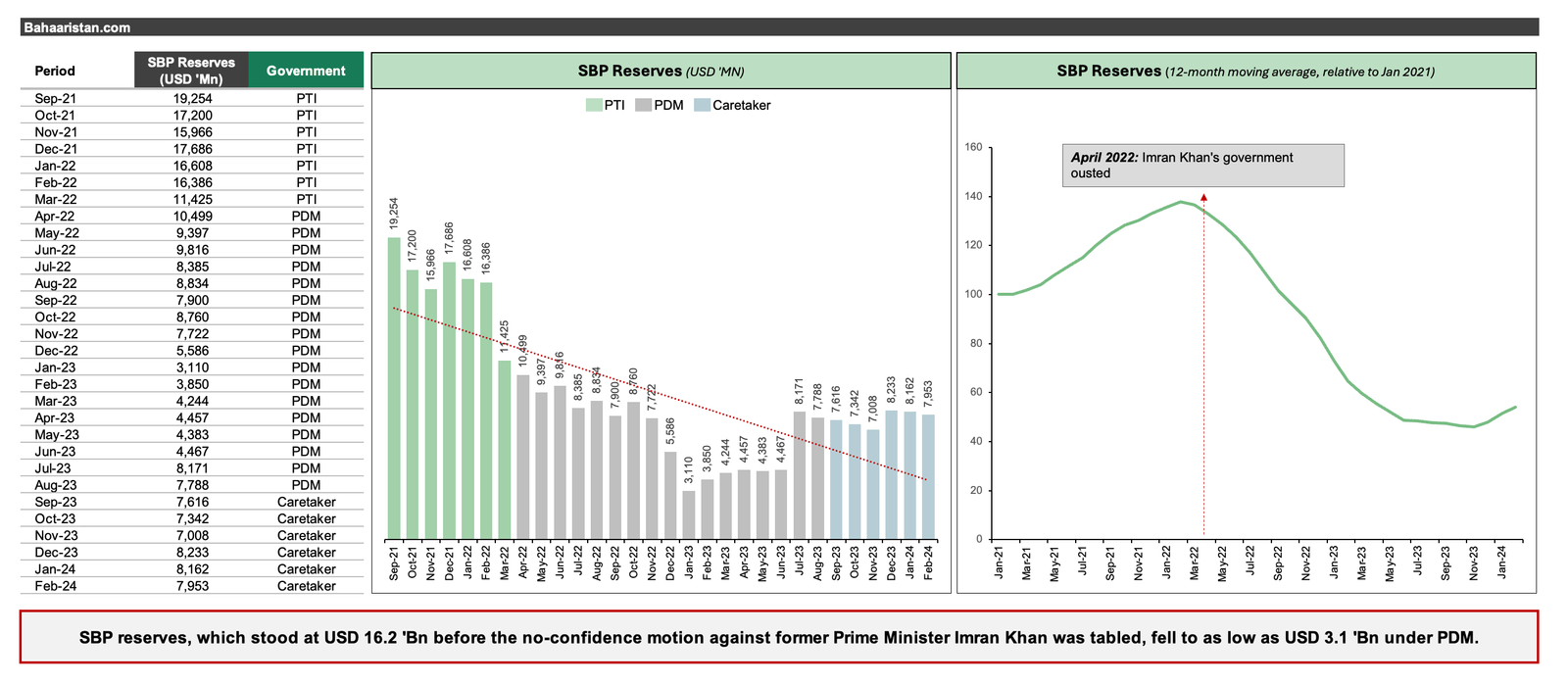

Pakistan’s Foreign Exchange Reserves

These factors directly impacted Pakistan’s foreign exchange reserves, exacerbated by debt repayments and political uncertainty. Before the no-confidence motion, forex reserves held by the State Bank of Pakistan stood at US$ 16.2 billion. However, by January 2023, reserves had significantly depleted, reaching US$ 3.1 billion, sparking concerns of a potential default.

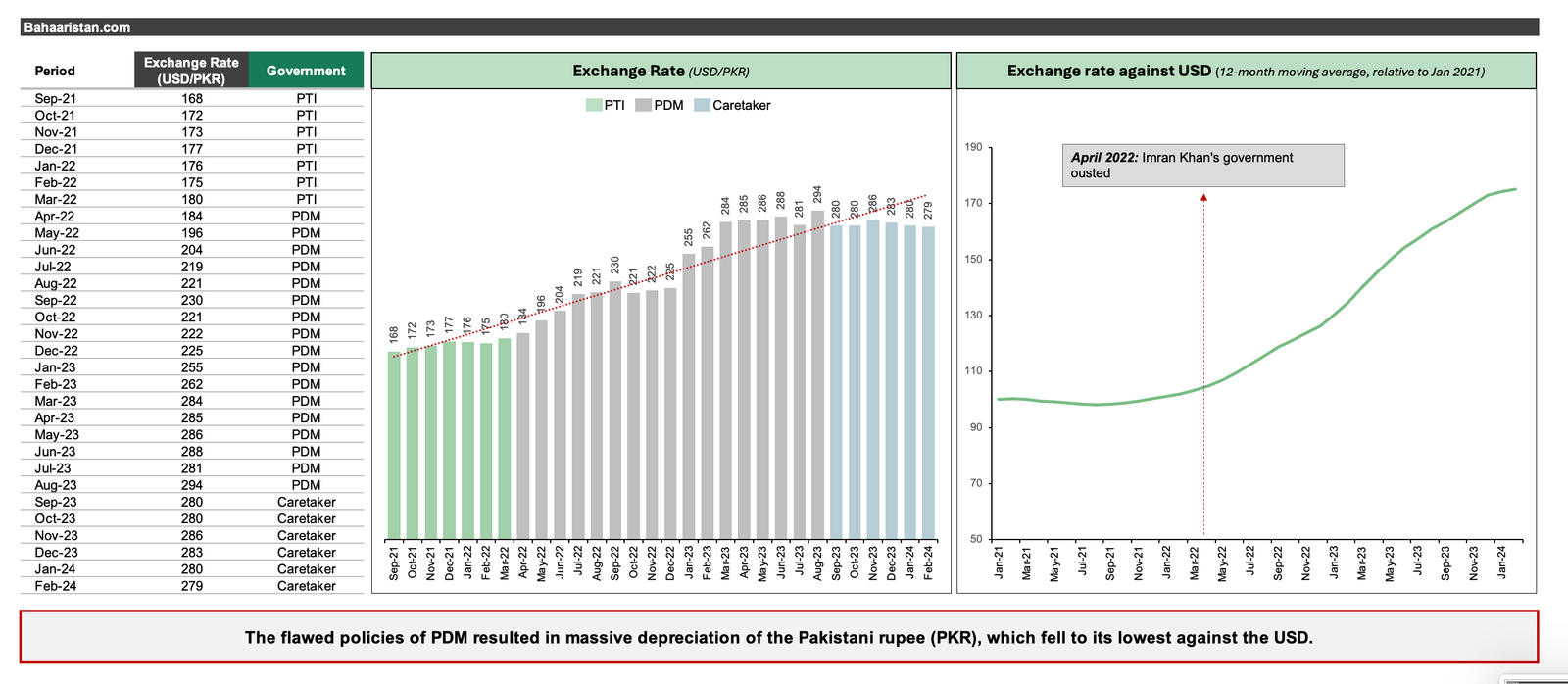

Pakistan’s currency

Low forex reserves & political uncertainty led to a drastic depreciation of the Pakistani rupee, which reached its lowest against the US dollar. When Imran Khan’s government was ousted, the US dollar was priced at PKR 176. However, it is now valued at approximately PKR 280 for each US dollar.

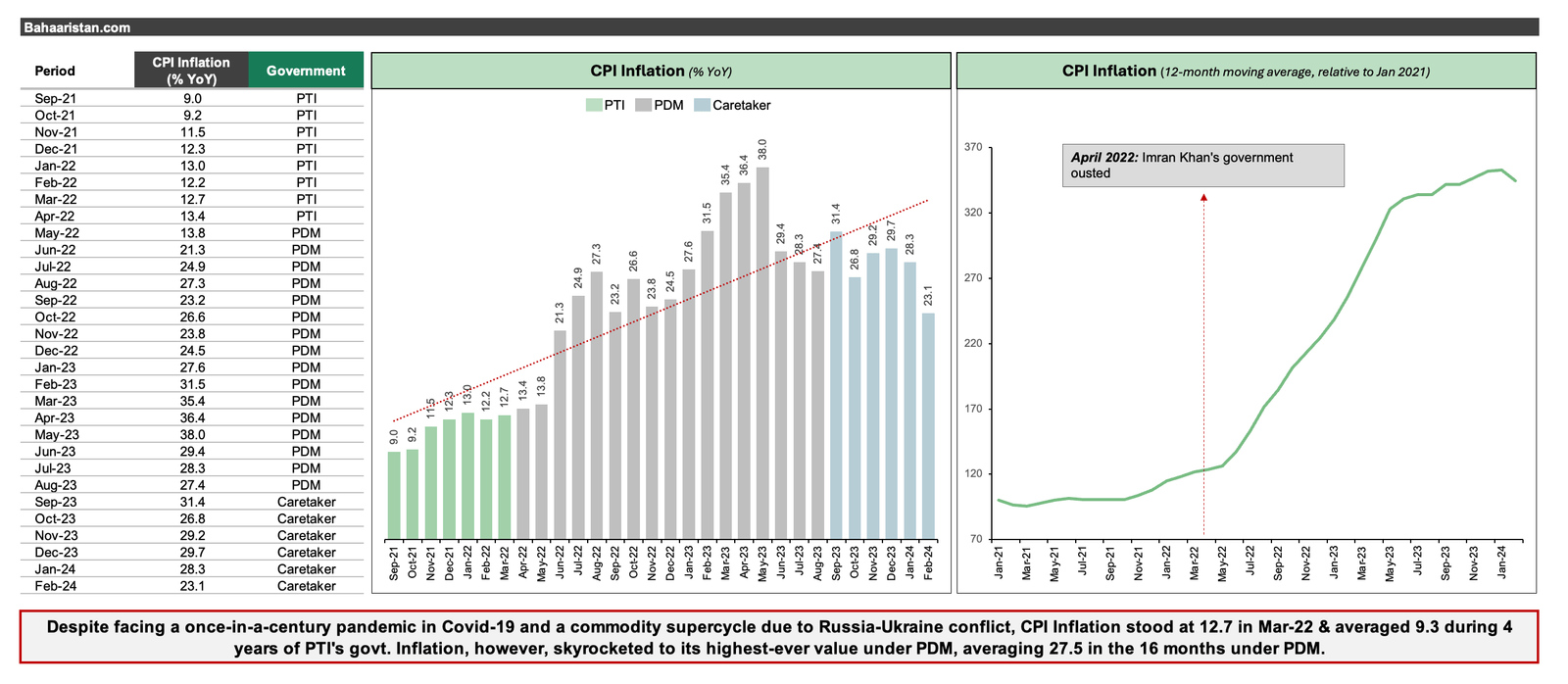

Inflation in Pakistan

Pakistan experienced uncontrollable and unprecedented inflation due to massive rupee depreciation. CPI inflation, averaging 9.7% during Imran Khan’s tenure and recorded at 12.7% in March 2022, skyrocketed to over 30%. In the 16 months under the PDM, inflation averaged 27.5%.

This inflation pushed 12.5 million people into poverty by September 2023, with another 10 million falling below the poverty line by March 2024, resulting in 40% of Pakistan’s population living in poverty.

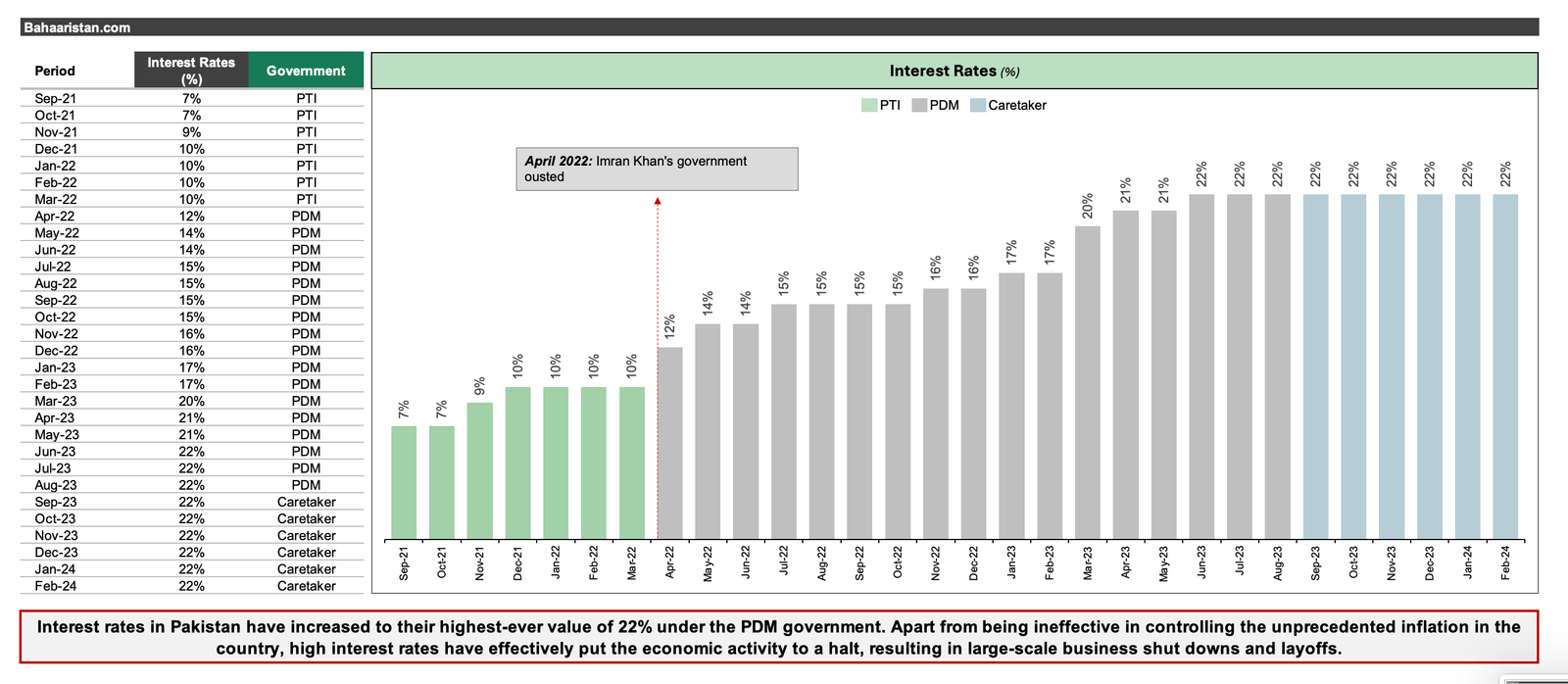

Interest rates in Pakistan

The impact of inflation was felt by businesses too, which suffered tremendously. To counter growing inflation, interest rates have been hiked to their highest-ever value. However, the high interest rates proved ineffective in curbing inflation and instead effectively put economic activity to a halt, resulting in large-scale business shutdowns and layoffs. In retrospect, the decision to hike interest rates to an all-time high and maintain them there for over a year has proven to be devastating for Pakistan’s economy.

Large Scale Manufacturing and Local industry in Pakistan

Large-scale manufacturing (LSM) is an indicator of the country’s economic activity. While Pakistan’s large-scale manufacturing reached its peak under PTI in March 2022, output has sharply declined since Imran Khan’s government was removed, reflecting the industry’s severe downturn.

Employment

The economic activity generated under PTI’s three-year tenure resulted in the creation of 5.5 million jobs. However, the economic downturn following the regime change operation has led to business closures and massive unemployment.