Pakistan

The Historic Fall of Pakistani Rupee against the US dollar

In this article, we will try to explain the factors that influence the exchange rate & why Pakistan’s currency devalued drastically under PDM.

Pakistan’s economy has tanked in the last 12 months under the PDM government. The country faces an imminent default, with foreign exchange reserves at less than $4.3 billion and debt-servicing due in June 2023. The nation of 220 million people is on the brink, facing record-high inflation, and large-scale lay-offs with the industry nearly shut down. Consequently, the Pakistani rupee (PKR) has nosedived against the US dollar (USD) and has reached its lowest-ever value.

In March 2022, the PDM tabled the no-confidence motion against then-Prime Minister, Imran Khan. At the time, the US dollar was valued at PKR 178/USD. Today, a dollar (USD) is officially valued at PKR 285/USD, and unofficially the dollar (US $) is being exchanged at as high as PKR 315/USD. In this article, we will elaborate in very simple terms on how exchange rates are determined, and why the Pakistani Rupee has depreciated to historic lows against the US dollar under the PDM government.

Assume that the US dollar ($) is a commodity. And so essentially, the dollar ($) rate is simply the price of 1 $. In other words, the dollar rate is defined by the amount of Pakistani rupees you have to give to purchase 1 $.

The price of any commodity is fundamentally determined by its demand & supply. If the demand for any good is high, while its supply is low, the price of that good increases. On the other hand, if the supply of a good is high, while its demand is low, the price will decrease. Using the same rule, if the supply of $ is low & the demand is high, the price of $ will increase. And if the supply of $ is high while its supply is high, the price of $ will decrease.

For most economies, there are two main sources of dollar ($) inflow, which form the supply of US dollar (US $) in the country:

- exports

- remittances

Meanwhile, at a macro level, dollars ($s) are predominantly required for:

- imports

- debt servicing

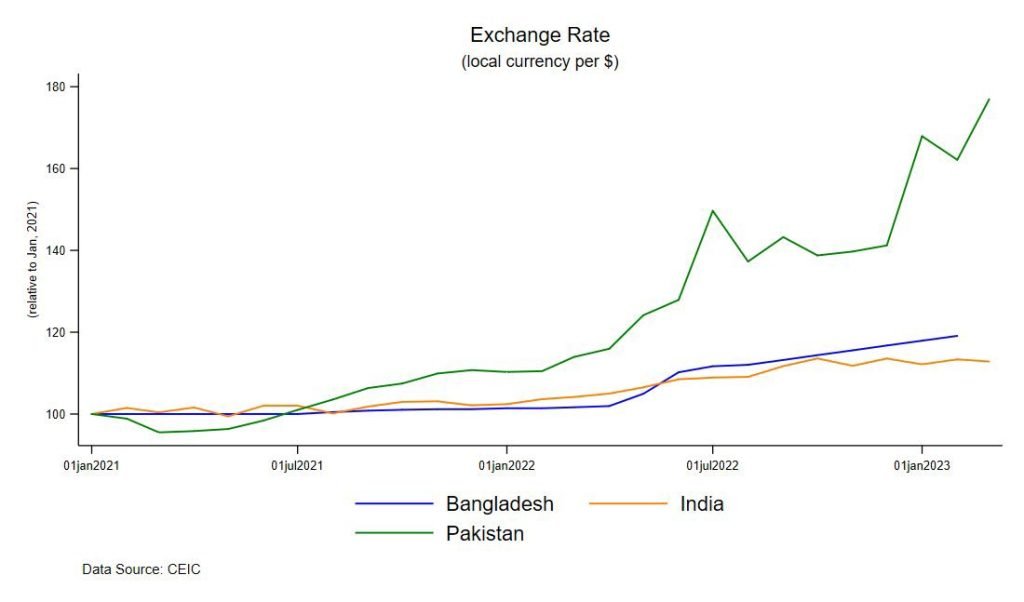

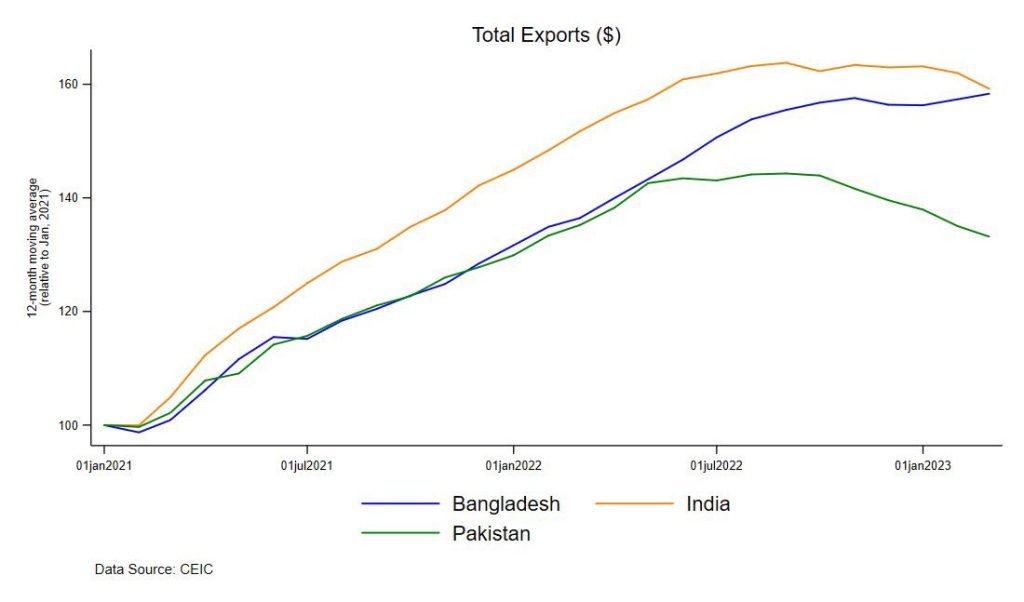

In Pakistan, over the last 12 months, both exports & remittances have decreased (see graphs)

Notice that the decrease in both started after the PDM took over the government. Also, while Pakistan’s exports declined, exports from Bangladesh & India have continued to increase.

There are different factors that led to the decline in exports & remittances, but that is beyond the scope of this article. For now, this decline meant that the inflow of US dollars (US $) into Pakistan decreased, i.e., the supply of dollars ($) was low. Meanwhile, the demand for dollars ($) is high, as Pakistan has a high import bill & faces high debt-servicing. This created an imbalance between the availability of dollars ($) & its requirement and resulted in Pakistan being dollar ($) deficient, i.e., with a shortage of dollars ($).

As a result, the price of the dollar ($) increased; therefore, today the Pakistani rupee has depreciated by nearly 60% compared to April 2022, and a dollar is priced at PKR 285/USD.